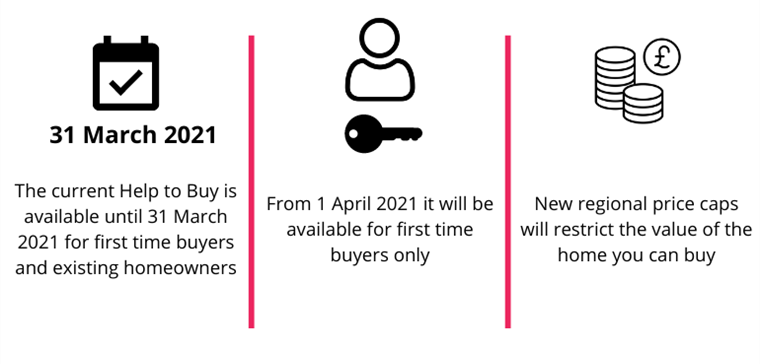

The Government’s current Help to Buy scheme will end on 31 March 2021 and a new one, just for first-time buyers, will start on 1 April 2021.

Still with just a 5% deposit and a 75% mortgage, first time buyers may be able to borrow up to 20% of the cost of a new home from the Government. The amount you can spend on your home will depend on where in England you’re looking to buy, click here to view the new changes and regional price caps.

You won’t be charged interest on the loan for the first five years. Interest fees start at 1.75% and rise each year in April by the Consumer Prices Index including owner occupiers’ housing costs (CPIH) plus 2%. You pay a monthly management fee of £1 for the life of the loan.

Homes England, the lender, secures the equity loan as a second charge on your Help to Buy home. You must repay the equity loan when you sell the home, pay off your mortgage or reach the end of your loan term. But, you can repay all or 10% chunks of the loan any time before then.

Whether you’re an existing homeowner or first-time buyer, find out more about these changes. You could still be eligible to use the current Help to Buy scheme, if you complete on your new home by 31 March 2021.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |